Finance Minister Nirmala Sitharaman presented the budget for Financial Year 2023-24 in Parliament on 1st February, 2023. The date of the speech itself represents a gradual policy reform: while Art. 112 of the Constitution obliges the government to present a budget (“annual financial statement”) every year, it does not specify the date of such presentation, nor does it require the presentation to take place on the same date every year.

Why does the date of the Budget Speech matter? Simply speaking, because the Speech is one milestone in a long process, which plays out over multiple months. It isn’t even the last one – once the Union Budget has been presented, Parliament debates it, then votes upon the Appropriation Bill; the Government then introduces a Finance Bill, which is debated, amended, and finally passed. Only when the Finance Bill has received the President’s assent can funds be disbursed to the various Ministries, PSUs, and state and local governments.

State governments, in turn, have to run their own budgeting process; this again requires preparation of the state budget, its presentation and approval in the state legislature, and the passage of a state finance bill before the funds can flow into the accounts of the actual implementing agencies. One key input to this process comes from the Union allocation bill: the state government has to know how much money the Union will provide in the forms of mission and scheme budgets, grants, etc.

What would happen if the Union Finance Minister were to present the budget on, say, March 15th? While this would still be within the financial year – as required under Art. 112 – it would leave barely two weeks for all of the subsequent steps. Historically, when budget presentation has taken place in March, state governments have struggled to complete their own budget and grant management processes; by the time funds are allocated and approved in the state treasury, a few weeks in the first quarter have already passed, and the various missions, schemes, and implementing agencies are forced to make a late start on their expenditures and work.

To ensure that the entire federal budgeting process is completed by April 1st, the budget preparation process kicks off as early as September, with the Union Finance Ministry issuing the Budget Circular. Budget ceilings for each Ministry are finalised by mid-December, and – after six weeks of intense preparation – the Union Finance Minister speaks on February 1st.

Research Spotlight: RBI Municipal Finances Report

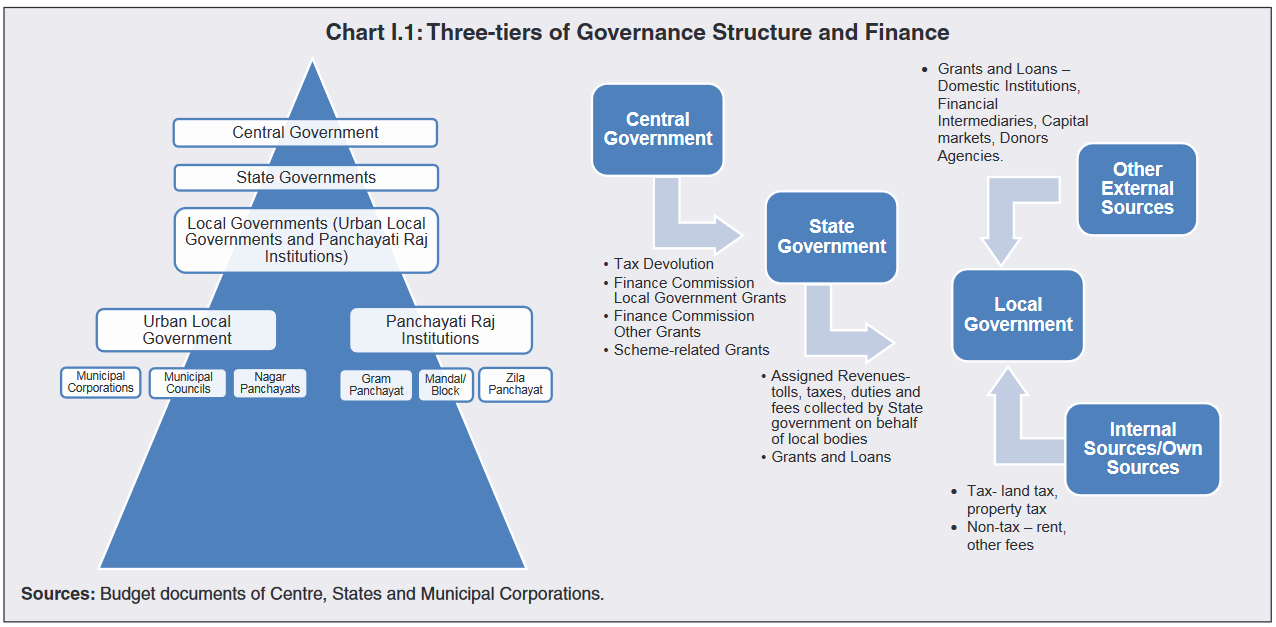

In November 2022, the Reserve Bank of India (RBI) published its first “Report on Municipal Finances”. The report notes that statistics on municipal finances and flow of funds are difficult to find or compile, as there is no standardised accounting practice at the ULB level; however, the RBI hopes to make the report an annual publication, gradually building up a more reliable database on municipal finances.

The report currently covers 201 Municipal Corporations across India. Improving statistics on the finances of Municipal Corporations – which account for ~70% of the finances of all ULBs – will be a priority for India as part of the G20 Data Gaps Initiative. The RBI will also incorporate data on Municipal Corporation finances in its regular reporting of general government finances.

The report notes that Municipal Corporations remain highly reliant on two sources of funds: grants from Union and state governments, and property tax. Among these, the share of grants has been growing; as of 2019-20 (Budget Estimates), property tax revenues contributed about 15.5% of all ULB receipts, while grants contributed over twice this number – 32% – suggesting an overall worsening in ULBs’ ability to meet their expenses through own revenues. (Table II.3, page 13.) ULB own revenue from sources other than property tax remain largely untapped.

A small number of Municipal Corporations have started raising funds through the issuance of municipal bonds. Between 2017 and 2021, nine cities issued a total of Rs. 3,840 crores, with the majority of these — over Rs. 2,500 crores — being issued in FY 2018-19. (Table A1, page 29.) This is partially explained by the fact that only 16 ULBs have a credit rating of A or better; as more ULBs receive better credit ratings, municipal bonds may emerge as a more viable source of borrowing, enabling more investment in urban infrastructure.

Reading and Events

- The Centre for Policy Research published a series of short talks, analysing various aspects of the Union Budget (defense, infrastructure, climate, social security / welfare, agriculture, and macro-fiscal outlook) – these can be viewed here.

- The International Monetary Fund (IMF) published a working paper titled ‘Stacking up the Benefits: Lessons from India’s Digital Journey’, which studies how India Stack “…has been harnessed to foster innovation and competition, expand markets, close gaps in financial inclusion, boost government revenue collection and improve public expenditure efficiency.” The paper was discussed at a seminar on 14th April; Finance Minister Sitharaman and Nandan Nilekani were among the speakers at this event – which can be viewed here.

- The Centre for Social and Economic Progress (CSEP, formerly Brookings India) conducted a seminar on “India’s New Growth Recipe“, discussing a recent CSEP working paper on the role of globally competitive large firms in India’s growth.

- If you’ve been reading about budgets and GDP and wondering what to make of all of it, this one’s for you: an old episode of The Seen and the Unseen podcast, featuring economist Rajeswari Sengupta, on “Demystifying GDP“. (Spoiler alert: Rajeswari suggests the average person probably need not try to follow or think much about GDP at all!)